Reef VS Alameda

The biggest deals aren’t done in public.

The real money changes hands OTC, where business is not so black and white.

Alameda entered into a deal with Reef Finance to make a “strategic investment”, involving purchasing up to $80m of REEF tokens.

When Reef sent Alameda an initial transaction of $20m REEF, Alameda quickly sent them to Binance, where they were sold or maybe used as collateral.

For Alameda to instantly sell tokens (that they received at a 20% discount) does not suggest interest in a long-term partnership with Reef, who expected to “explore the angle of integrating with Raydium and Serum on Solana for liquidity.” as had been described by Alameda VC Brian Lee.

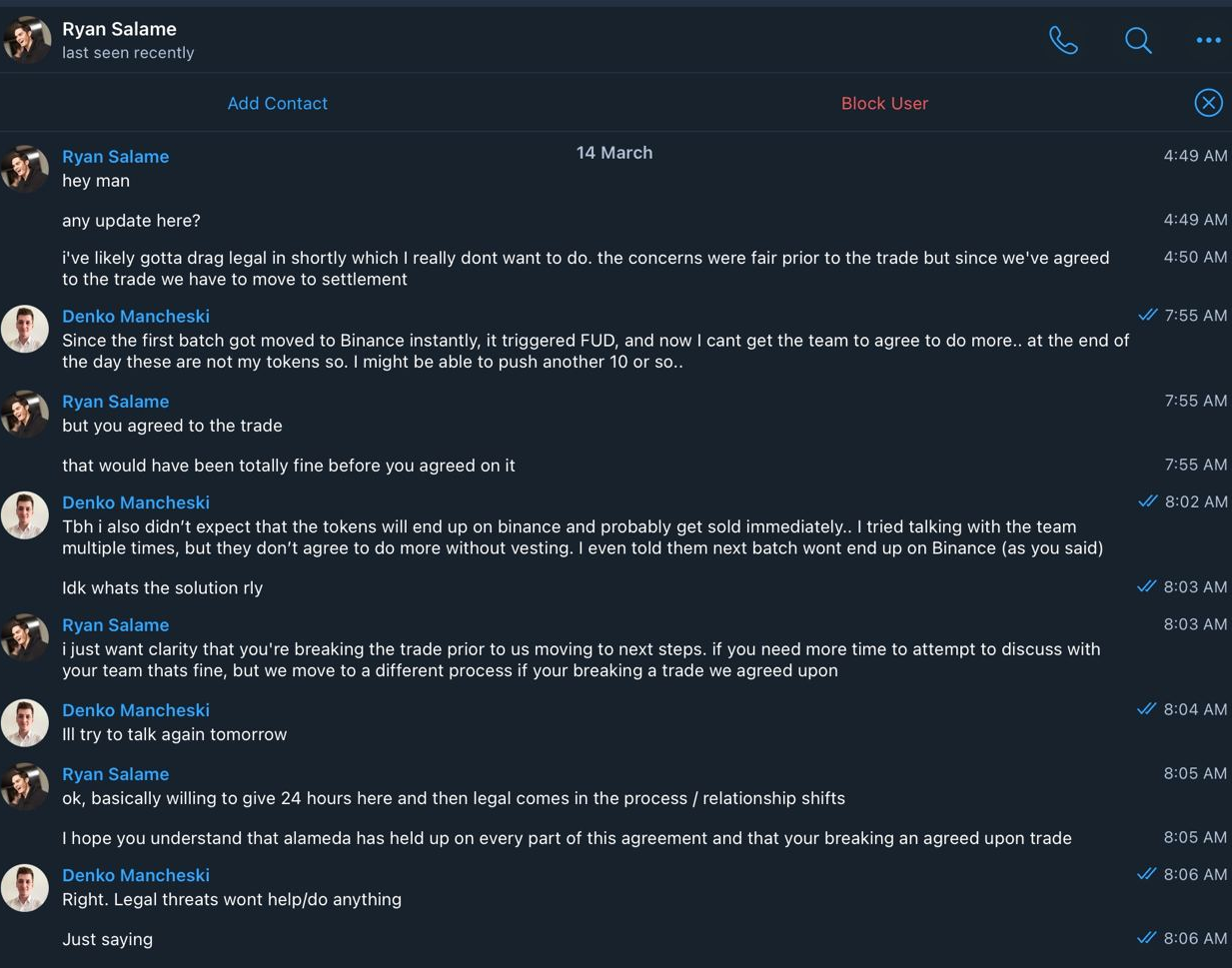

Alameda maintain that;

"It is not true that Alameda immediately sold all of the REEF."

However, when we reached out to Brian Lee and Sam Trabucco to ask how much REEF they still had left, Lee had no comment, and Trabucco said;

“What I have already said constitutes my comments on this.”

Centralised exchanges are a useful hiding place. CZ can see you, but the public can’t.

The following transactions show the movement of REEF tokens to Alameda and on to Binance, where we lost the trail.

Explorer 0x94e509b0f855297c0b99ab61bff027e0ad114121&p=6

Test 0xbff3f0abed08da6b49797ca955fe7fc09cebf66657c97cdbc007e8c5d71b895d

Tx1 0xec84307077d8285acedc1429e06a291ffc13e0987378b9d783d0e791087ba4bd

Tx2 0x2fa47499170c7c97c8c416d4679b8c3c3e8e4131d32475c488567e841d79f31c

Tx3 0x46ec76555f114b5247a18c194f5f93900d12890329a355ac5d380c5ff6c58062

Tx4 0xcf55423dcc16830fab59b218aa12c21ac30bab8ece60c605d1bb0ece4325f616

Tx5 0x30d4a0c0e33d9e902ad31946d24365a502e424f283c63eb29f678bdbdadc5882

Send to Binance 0x713fe44dd00562d2357daf0116c18013ca2b1a1697d326be86

This looks bad on both sides. The deal confirmation is shaky at best, and neither party comes out on top.

Reef is back tracking on a trade, and obviously this would irritate the other party. However, they have not broken any law by doing so, so Alameda trying to intimidate with legal threats isn’t a good look.

As SBF said on Twitter;

Sometimes one team has way more reputation to lose than another. That creates an asymmetry in PR fights.

In that respect Alameda lost, but that doesn’t mean Reef won.

Vance Spencer (a venture capitalist) said the following:

"If you want to raise venture capital, raise it from venture capitalists with a 10 year hold period and clear incentives. Prop desks/HFs are just larping as VCs."

Perhaps he’s right. Maybe Reef should have known better than to expect a long-term investment from one of the most savage trading desks in the business.

It does seem like unethical behaviour, but if it was within the contract then who’s to blame?

There’s a human element to OTC deals that isn’t present when buying from the market.

One advantage of smart contracts is that you can explore their logic and understand how they operate - not the case when transacting with humans.

Fear and greed can get the best of anyone, and neither party has come out of this story unscathed.

Emotions were riding high on all sides, as multiple tweets were sent only to disappear at a later date.

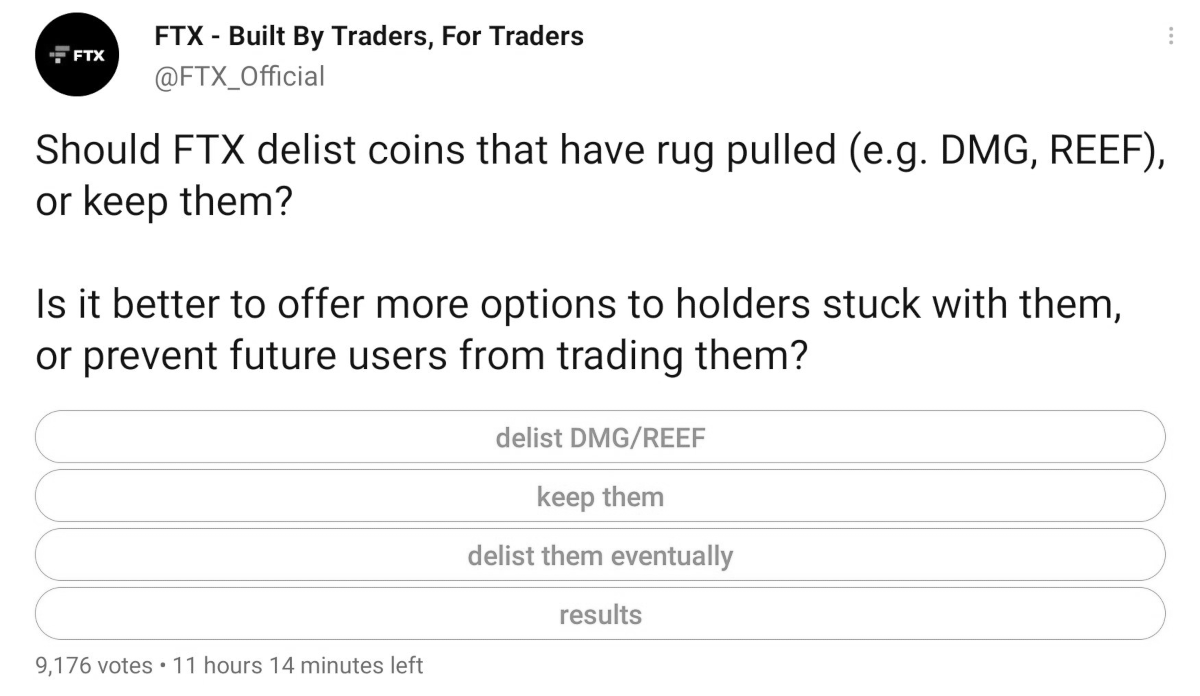

The following poll was published (and then deleted) by FTX, proving that the lines between Alameda and FTX are nowhere near as defined as SBF has previously told us.

Even market indicator KSI felt strongly enough about the topic to say the following, before later deleting.

All parties probably wish they could delete this whole incident.

It’s not a great look to go public with this kind of story, especially when the details are so messy and unclear.

Threatening to delist based on a deal gone wrong isn’t professional, but seeing as that was deleted too, it seems FTX are aware of that.

Does all crypto have to be decentralised? Reef bagholders using the hashtag #boycottFTX seem to think so for now, but centralised systems will always have their place.

Reef were looking for promotion so they could profit, Alameda went for profit directly.

Two players bumping heads as they take different routes to the same end goal.

Some things are better left unsaid.

If you enjoy our content, please consider donating to our Gitcoin Grant.

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.

you might also like...

Bulls Behind Bars

SBF is on trial and Su Zhu has been arrested in Singapore. Couple more arrests then up only? Washing out the apex-grifters presents an opportunity to return to crypto’s original ethos. Will we use it?

SBF - MASK OFF

SBF’s meltdown has gone from bad, to worse, to weird. The facade has fallen, and all his “beliefs” have turned out to be bullshit. The crypto movement is bigger than the failures of the past week, or at least, it will be...

FTX - Yikes

It’s all come crashing down for SBF, FTX and Alameda. Whether motivated by greed or altruism, the result is the same. The ends don’t justify the means - not when it ends like this.