Celsius - REKT

Celsius is burning up.

Over the past few days, rising temperatures at CeFi lender Celsius saw CEO Alex Mashinsky feverishly hit back at public accusations of insolvency.

Now the market is taking another battering amidst skyrocketing inflation and a liquidity crisis which has Celsius in the spotlight.

The public now believes that, despite claiming “military-grade security” and “next-level transparency”, Celsius has been gambling user deposits through on-chain leverage, hoarding illiquid ETH and getting rekt just like the rest of us.

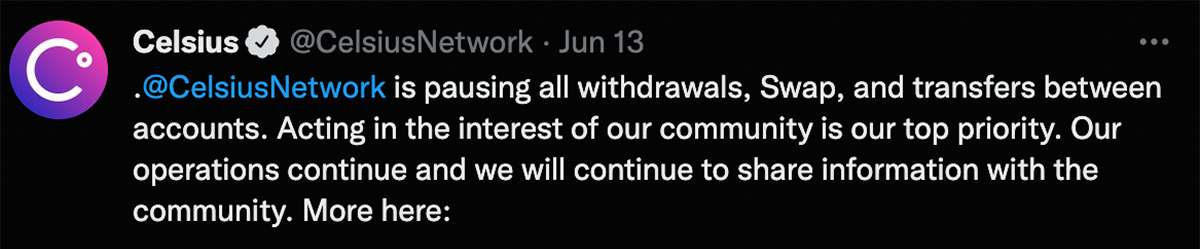

Initial concerns over illiquidity turned to panic over insolvency, and then came the announcement:

As Celsius themselves said in 2019:

“If you don't have free and unlimited access to your own funds, are they really your funds?”

The market answered:

As the Celsius crisis reaches boiling point, and both crypto and traditional markets plummet, we wonder, how did we get here?

Worries around Celsius have been circulating for some time, but recent investigations of the firm’s active positions amid a struggling market began to ring alarm bells.

Of particular concern are the large amounts of staked ETH held by Celsius (~$500M of which was pulled out of Anchor Protocol), and the liquidity crisis this creates.

While the 288k ETH that Celsius has staked directly into the Eth2 Deposit Contract isn’t redeemable until after the mainnet merge, wrapped stETH can be traded freely.

However, the only substantial on-chain liquidity for stETH is ~125k of ETH in the Curve pool, which has already become heavily unbalanced. ETH currently commands a premium of ~5% over its staked counterpart, over a year’s staking yield.

And having ETH locked-up isn’t their only problem. Celsius also has 18k WBTC ($420M) in MakerDAO at risk of liquidation if BTC continues to tank.

As well as their current positions, Celsius has lost a total of $120M over the last year: ~$70M in StakeHound-wrapped ETH and another $50M in the BadgerDAO hack (before a commiting a self-rekt on the recovery plan).

In order to process mass retail withdrawals, Celsius needs liquid assets quickly.

Celsius are left with two options; either further borrowing against a precarious and illiquid collateral which could lead to liquidations, or borrowing from elsewhere to increase their collateral.

But now everyone knows that Celsius is in trouble, so potential lenders will not be acting charitably as they position themselves to profit from Celsius' desperation.

While we can only speculate what’s going on behind the scenes, it looks like Celsius are hoping to make deals with the usual suspects.

Alameda’s costly stETH dump was followed by heavy inflows of stETH to FTX (coupled with rising open interest on ETH perps); leading some to suggest that Alameda is buying stETH OTC from Celsius and hedging their exposure.

As well as unloading stETH, Celsius sent 3500 BTC ($95M) to FTX yesterday, with a total of 11.5k BTC (<$300M) sent via the same route over the last month.

And it’s not just OTC dealings. Celsius have been desperately topping up their WBTC collateral on Aave to avoid a mammoth liquidation. Fortunately for all of us, their liquidation point has been brought down from ~$22.5k to ~$17k in the last 24h, and loan repayments have begun.

But will Celsius be able to shuffle its remaining funds around long enough to survive the heat?

As Celsius burns and prices nosedive, liquidation engines are amongst the few still making profits.

Those with funds locked in Celsius can’t escape and can only watch with fingers crossed, prevented from any legal action by the company’s Terms of Use, which have always stated that funds “may not be recoverable”.

But it’s not just retail that are being left out in the cold. Celsius investors are a varied bunch, including Tether (who were quick to assure that their $1B investment has no correlation with USDT reserves) and a Quebec pension fund (even the Boomers are getting rekt this time).

And as always, scammers are capitalising on the drama via a $CEL2 token, airdropped to genuine Celsius addresses to feign legitimacy.

Even if Celsius is long-term solvent, banking on them until after the merge, when their staked ETH becomes liquid, is too much of a risk right now for those who can afford to take it.

However, CeFi competitor Nexo did “reach out” to offer an acquisition deal, which was promptly refused.

Whatever the outcome for Celsius, this incident has already been labelled by many to be the cause for cascading liquidations across already suffering markets.

And with plenty more 8 figure liquidation points tickled overnight, who knows where this will end, or how far the fallout will spread.

CeFi going full degen with user funds will be used as a way to further demonise DeFi by those that don’t approve of financial autonomy.

However, the transparency inherent with DeFi protocols would have prevented Celsius from hiding their activities and allowed users to exit before it was too late, despite Celsius ignorantly claiming otherwise in the past.

The general public, however, will not make that distinction, as they will be distracted by the crashing prices and tragic stories of misled investors which will circulate for the second time in as many months.

While Celsius may have triggered this crash, and Luna the one before it, it’s clear that cryptomania has remained unsustainable for too long.

Now, playtime is over.

Thanks to the likes of Celsius, Coinbase, Crypto.com and FTX, those who bravely entered the market as a way to escape rising financial hopelessness will by now be put off for good.

Even experienced traders with positions which, a few months ago, would have been considered responsible will find themselves capitulating to save their health factor, or liquidated.

The markets will purge the unsustainable schemes that we have accumulated over the past two years and we will come out the other side battered and bruised, but stronger.

But will we have learned from our mistakes when the markets finally recover?

If you enjoy our work, please consider donating to our Gitcoin Grant.

REKT serves as a public platform for anonymous authors, we take no responsibility for the views or content hosted on REKT.

donate (ETH / ERC20): 0x3C5c2F4bCeC51a36494682f91Dbc6cA7c63B514C

disclaimer:

REKT is not responsible or liable in any manner for any Content posted on our Website or in connection with our Services, whether posted or caused by ANON Author of our Website, or by REKT. Although we provide rules for Anon Author conduct and postings, we do not control and are not responsible for what Anon Author post, transmit or share on our Website or Services, and are not responsible for any offensive, inappropriate, obscene, unlawful or otherwise objectionable content you may encounter on our Website or Services. REKT is not responsible for the conduct, whether online or offline, of any user of our Website or Services.